7 Ways To Destroy Bad Credit...Once And For All

Written by :

Kimbery Ashington

June 10, 2020

Have you recently applied for a mortgage only to be turned down by your lender of choice?

It’s very likely, that even if you have a salary that pays $80,000 a year, have enough down payment for 20% on a $400,000 home and no debt that your application can still be denied? Or perhaps, you had a few too many late payments posted to your cell phone account in the last 2 years. Its even possible that some information in your credit file was not even yours to begin with!

Yes it can happen.

Your credit report and it’s score work in tandem to open up many doors and unfortunately, can also close them.

You mustn’t deny yourself possibilities in the world of credit. Having the right tools and focused insight can give you that edge and lead you to success when it comes to borrowing.

We’ve compiled this list of 7 ways to destroy your bad credit even if you don’t have any credit at all. But first, let’s answer some important questions you might have.

We’ve compiled this list of 7 Ways To Destroy Your Bad Credit even if you don’t have any credit at all. But first, let’s answer some important questions you might have.

or

I want to fast forward directly to…

We’ve compiled this list of 7 Ways To Destroy Your Bad Credit even if you don’t have any credit at all. But first, let’s answer some important questions you might have.

I want to skip the questions and Go Right To The List

or

I want to fast forward directly to…

Did You Know?

You might be surprised to know, that many Canadians are completely oblivious to what their credit scores are and how this factor could adversely affect their upcoming application with the bank for new funding with that upcoming mortgage.

But what are credit scores and how are they calculated? Who has access to them and if my credit score is substandard then what can I do to improve it?

Credit scores are a number given to every individual within the system that can assist lenders in determining your credit worthiness during the application process for a mortgage, student loan, personal loan, line of credit and almost all credit cards.

If you’ve ever had a credit card or a mortgage then you certainly have a credit score. Even individuals that don’t have approved credit but are currently, or have in the past, paid a utility bill- such as water and waste removal – or cell phone and internet/cable charges from companies like Bell or Rogers, have a credit score assigned to their file.

What is Considered a Good Credit Score?

Credit scores range from anywhere between 300 to 900, and as I’m sure you’ve guessed the higher the number the better. For those wanting to breeze through any approval process or for any number of applications involving personal funding the magic number that all Canadians are striving for is around the 660 mark. Anything above this is considered good. Anything below this score will hurt your chances of approval or if you are approved might give you higher interest rates and dig into your savings.

What are the Factors in Determining Your Credit Score?

Fair Isaac Corporation, more commonly known in North America as FICO, is the leading analytics software developer whose products are commonly commissioned for use in processing credit scores using algorithms that can predict consumer behaviour in order to manage risk, combat fraud and establish customer relations for lenders and banks alike.

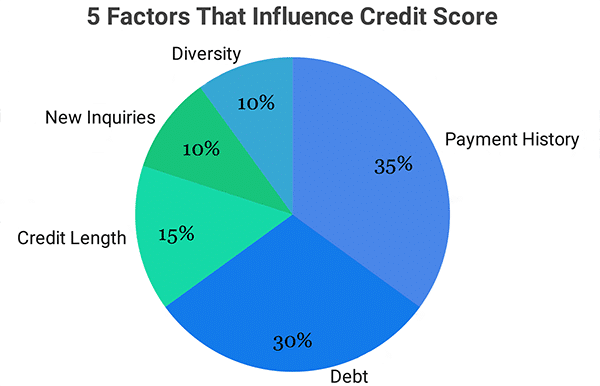

According to FICO, there are five general factors that are used to determine your credit score.

- Payment history – This being the single most important factor accounting for 35% of your score. The objective here is to exercise a strict personal schedule of No late payments over 30 days. Play this card with all your account every month and you’ll be sittin’ pretty.

- Debt – Keep a firm grip on the amount of your total debt. Be aware of your numbers and proactively take steps to manage it. This takes up about 30% of the total pie.

- Credit Length – The length of your relationship with all of your lenders plays in important role. Of course, the longer the better. This totals up to approximately 15% of your score.

- New Inquiries – If you’ve applied for or have been approved for any new credit it will show up in your report. It’s important to limit this as much as possible as it can negatively affect your score. This will account for as much as 10% of your current score.

- Diversity – The different types of credit accounts that you hold in your name can also affect your credit. This final element is responsible for the remaining 10%.

I have a credit score of 620. Do I have any options to improve it?

Yes! You certainly do.

Below is a list of what we consider to be the top priority. Not all of the following conditions are appropriate for each and every individual but everyone can benefit from just a few of these. It is very case-specific and very important that you are up-to-date with your current credit file. You can assess your situation and use the guide below to help navigate you towards the upper tier, sooner than later.

We highly recommend you order a copy of your credit score and detailed report from either Equifax or Trans Union. there is a charge for the services, therefore alternatively we could recommend a choice from one of these 2 services for no charge.

Credit Karma – Uses the TransUnion algorithms and reporting system.

Borrowell – Uses the Equifax algorithms and reporting system.

Hack No. 1

Check for Errors in Your Credit Report

Many people are unaware of their credit scores and the information inside them. Quite often and more than you realize errors can occur within your credit report and it’s up to you to correct them.

Check for anything from misspelled names and addresses, your ex’s debts appearing in your report and even complete omission of certain accounts.

If you’re curious as to why accounts missing from your report can have a negative impact consider this: Any accounts that are in good standing (no late payments for 12 months or longer and certainly nothing sent to the collections department) can actually help raise your credit score but if missing from your report would be a waste and a shame.

For a more in-depth look into the details of your credit report and what types of errors you might find check out this great article.

If you’ve never received your credit report before, there are two main bureau’s within Canada that all financial lenders look to for “The Dirt” on your spending habits.

The great news, is that as an individual you will also have access to this information. Both offer 1 free report per year, which is your right as a Canadian citizen.

If you’d like to see what’s going on in your credit report today – you can get it through a secure connection at either Equifax or TransUnion. Registering is easy, you will need your Social Insurance Number and some personal knowledge of active account’s and balances. You’ll receive it within minutes after you sign up.

Credit Karma also offers reporting and score services with the big difference being that Credit Karma is always free, however it piggybacks on the TransUnion model and algorithms, and while being accurate with their figures, offers substantially less detail than the parent service.

Hack No. 2

Apply for an Increase in Your Credit Limit

If you apply for a credit increase and are approved, you can almost increase your credit score overnight as your ratios have now changed because your balance remains the same but your credit ceiling is now higher.

In a perfect world, you would pay off your balance in full before the end of your grace period. Unfortunately, most of us don’t live in that world, so back here on earth, lenders use a percentage called “Credit Utilization” to determine your worthiness during the application process with a new bank.

The standard ratio of 3:10 or more commonly displayed as 30% is what most lenders use as their benchmark. It’s the go-to percentage that you are striving for.

In simple terms, it is a comparative tool to help lenders determine how much you owe vs. the total amount of credit you are allotted, aka, your credit limit.

As an example, if Cardholder A has a credit card with a balance of $2000 and a total limit of $7000 their ratio would be 2:7 or as a percentage, 28.5% rounded up to 29%. Just below the threshold, this cardholder would appear responsible to practically any financial institution.

On the flipside, if Cardholder B has a credit card with a balance of $6000 and a total limit of $10,000, their ratio would be 6:10 or displayed as a percentage, 60%.

Well above the threshold, this cardholder would severely affect their own ability to be approved for a new line of credit and most certainly a mortgage.

Hack No. 3

Apply for a Secured Credit Card Account

If you’ve been plagued with bankruptcy, have bad credit or have no credit history to begin with, then you might have a hard time getting approved for a standard-issue credit card.

That’s where secured credit cards come in. By supplying the bank with an upfront deposit, usually between $200 and $10,000 you will have access to one of the major credit card networks in Canada such as Visa or MasterCard.

A secured card allows you to practice forming good habits and responsible use whether you are new to credit cards or have had previous trouble spending beyond your means. Perhaps one or two purchases per month and paying your balance in full before the due date, will help to improve your credit score which will allow you to graduate to a standard Visa or MasterCard in the not to distant future.

One of the great things with most secured credit cards is they don’t require a credit check and practically everyone is approved no matter your prior credit history.

If you are in the market and interested in finding out more about this topic and how it might help you, we’ve put together this article reviewing todays best secured credit cards for bad credit designed specifically to help you improve your score and your report.

Hack No. 4

Don’t Cancel Accounts You Aren’t Using

You’ve got some credit cards that you really haven’t used for a while, but don’t make the mistake of cancelling those accounts just because you aren’t making purchases with them.

If these accounts are in good standing and have a zero balance they could actually help to increase your credit ratio and display a healthy utilization on your credit report.

Think of it like applying for a credit increase from Hack #2. Instead, you’ve already been rewarded with the increase and now you’ve just got to take advantage of it.

Try making one purchase per month maybe for groceries or transit costs (like subway fares or gas) especially since you will be needing these things anyways.

The key here is to pay them off soon but not too soon. Wait at least 15 days so it shows up on your credit report but no more than 21 as this is usually the standard number of days before interest accrues. (Check your credit cards fine print in the agreement that came in the mail when you first received your card. Some cards have less grace period and some have more)

Using your card in this way gives your credit score a little boost since your previously dormant accounts now appear active and shows potential lenders that you can handle credit responsibly by making timely payments and resetting your card back to $0 every month.

Hack No. 5

Refinance Your Debt With Low-Interest Options

Hack No. 6

Have a Variety of Different Types of Credit

Having four or five credit cards show up in your credit report, with optimal utilization and no late payments is not necessarily a bad thing. But we suggest you change it up a bit.

According to FICO, there are 5 major factors used in calculation when providing a score to lenders during a “Hard Check”. Variety comes at the bottom of the list and accounts for approximately 10% of your score.

Still, if you’re trying to squeeze every last drop of insight to help boost your credit score and its a previously untapped opportunity then its worth looking into.

It’s important to display some form of diversification within your active accounts. This shows the credit bureaus your ability to juggle many different variations of finances simultaneously. Whether it be having the option to lease an automobile, getting approved for a mortgage or opening a small line of credit at your local branch, there are, as you can see, a few options that can be exercised to take advantage of this scenario.

We’re not saying to run down the list and knock off as many as you can. After all applying for too many different types of credit in a short timeframe can seriously damage your score. Just choosing one of these avenues is sound advice.

Maybe you’re thinking of going back to school or just applying for the first time. You might need a student loan. Now’s a good time to stuff that into the mix, but only because it’s relevant to a big life decision. Higher education. Don’t just decide to take a few courses at a local college with the primary intention of bringing the relief pitcher in to throw a curveball at the credit bureaus for the sake of advancing the score.

It really comes down to looking at your situation and saying “Could I benefit from one of these avenues with regards to the direction I am heading?” If so, then suit up and don’t be surprised if you see a small, yet positive change in your report, after you make your first five or six payments by the due date.

Hack No. 7

Employ a Strategical Plan When Shopping for Credit

Did you know that when you apply for a loan or credit card your lender has to perform what’s called a “hard credit check”. Essentially what this does is allow that lender to pull your file and make sure that your credit score and spending habits are good enough for the type of financing that you’re shopping for.

Many consumers are already aware that a “soft check” will not hurt your credit score but a “hard check” can lower your score by several points. This is why it’s advised not to apply for too many credit cards in a short time frame as this might lower your score even more, with each successive pull.

However, there is an exception to this rule.

FICO employs a series of calculations to determine when a consumer is applying for single loan across multiple lenders, within a set period of time, attempting to get the best possible rate. There are two basic rules that dictate this situation:

- The loan that is being applied for should fall within 1 of 3 categories:

- Auto loan

- Home Mortgage

- Student loan

- All applications should circulate within a 30 day “buffer zone” period.

In regards to rule number 2, different sources cite varying number of days to keep those multiple applications within, ranging from 2 weeks to 45 days. FICO likes to keep a tight lid on the real truth.

On US soil FICO employs a 30 day “buffer” and a 45 day deduplication (otherwise known as a “dedup”, pronounced dee-dupe), where multiple checks for the same type of loan, within a rolling 45 day period, is not counted as a second pull. Whether FICO’s rules of engagement apply similarly north of the border is difficult to say.

Our recommendation is to keep all applications for that individual loan type within 30 days. No matter if you have 2 or 5 applications, your credit report will only view it as 1 hard pull so long as you keep it within that timeframe.

What Next?

Well, first things first. Get yourself a copy of that credit report. Go over the credit report with a fine tooth comb and look for any obvious errors that can be instantly rectified through a phone call.

Check on that report to see where you can improve on credit utilization with each account. Get all those accounts below 30%! If you do that you’ll be in great shape. And don’t forget to pay all your bills on time. Don’t get behind ever, if possible.

Here’s a Rock Solid Option

Many lenders offer great promos like low or no percentage balance transfers, though these are usually temporary and can last anywhere between 2 to 3 months and as much as a year.

Keeping this in mind, having a backup credit card for emergencies, especially one with a year-round, permanently low APR is a sound choice.

Unfortunately, you can’t predict when emergencies are going to happen, but when they do, you may need access to funding beyond amounts that are currently available in your savings account.

Don’t wait until that happens to learn your lesson in hindsight.

You can find and compare some of the best credit cards in the low interest-rate category, and discover the number 1 pick – voted in by everyday consumers like yourself- for the most sought after and lowest interest rate credit card we could find.

Now It’s Up to You. Take Action

We’ve given you lots of suggestions and although this list is exhaustive don’t be overwhelmed by thinking you have to use all seven of these on the list. It’s important to assess your financial situation, and choose one or two of these that might be particularly helpful to you.

It doesn’t take much but a little patience and know how. With careful planning you’ll be ready when it comes time to take out that big loan from the lender of your choice.

Related Topics