Written by :

Clive Shapiro

July 12, 2020

You’ve made up your mind. You’re ready to buy your first home. You’ve been saving up for several years, cutting costs in as many places as you possibly can just to stuff an extra couple hundred dollars in your savings account every week.

You’re excited about this new chapter in your life, yet at the same time, you’re a bit anxious. There’s so much information, so many terms you’re not familiar with and as such, it can get very confusing.

You have many questions. You need not worry.

I have the answers for you.

There’s a lot here to go over, and you might be a while. Go to the kitchen and brew yourself a fresh pot of your favourite coffee. Sit back and relax.

Let’s get started…

Table of Contents

– Click on a Category To Jump Right In –

- What is a Closed Mortgage?

- A Comparison: What is a Fixed Rate vs. a Variable Rate?

- What is the Difference Between a Home Appraisal and a Home Inspection?

- What are the closing costs?

- What is land transfer tax and do I have to pay it?

- What will my property taxes be and where can I find that out?

Table of Contents

Click on a Category To Jump Right Into It

- What is a Closed Mortgage?

- A Comparison: What is a Fixed Rate vs. a Variable Rate?

- What is the Difference Between a Home Appraisal and a Home Inspection?

- What are the Closing Costs?

- What is Land Transfer Tax and Do I Have to Pay It?

- What Will my Property Taxes be and Where Can I Find That Out?

How Much of a Down Payment Do I Need?

Unfortunately, there is no “one size fits all” answer that applies as every individual’s circumstances might be very different from one to the next.

Good news though, as I can lay down some ground rules so you know what you’re working with. This should help you narrow down your options and allow you to choose how much of a down payment is right for you.

In Canada, you can get yourself into a home for as little as 5% down. This means that on a $300,000 home you can put down as little as $15,000.

On the same home, if you decide you would like to put down 10% then you would offer up $30,000, and at 15% you would need to fork over $45,000.

Once the asking price exceeds $500,000 the minimum down payment becomes 10%, however the 10% only applies to any amount in excess of $500,00.

Jake put a bid on a cottage – listed by the owner Selena – in the Muskokas for $670,00.

If Jake and Selena come to an agreement on that price, then the minimum down-payment would be calculated as follows:

5% of the first $500,00 = $25,000

10% of the remaining $170,00 = $17,000

$25,000 + $17,000 = $42,000

Your Total Minimum Down Payment would therefore be $42,000

By Canadian lending standards, mortgages with down-payments under 20% are considered high ratio. As such, you would be borrowing somewhere between 81% to 95% of the total purchase price. Under these circumstances you would be required to obtain mortgage insurance from the CMHC which is required by law and gives your lender protection in case you default in your payments or are forced into a foreclosure.

For homes over $1 million dollars, the CMHC doesn’t offer default insurance, which means that a mortgage in this price point would be subject to a minimum of 20% down-payment of the entire list price.

If you are fortunate enough to have access to funds that exceed 20% of a down payment, you are no longer considered to be of high risk and subsequently become exempt from this fee.

The Canadian Mortgage and Housing Corporation – also known as CMHC – evaluates how much insurance you would have to buy and calculates that as a percentage of the final agreed selling price.

As of 2016 some new rules and regulations were added for new home buyers. The CMHC offers substantially more details including the new rules as of 2016 and specific examples of how much you might expect to pay on a house using different combinations of total price vs. down payments.

What Does My Credit Score Need To Be?

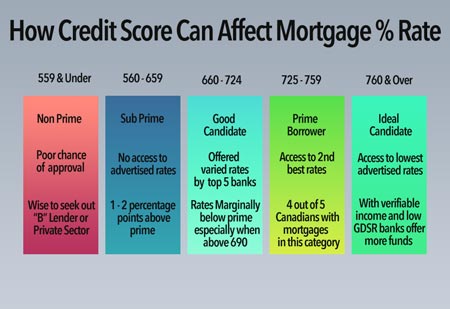

Your credit score has a big impact when it comes to your chances of getting the stamp of approval from your lender of choice. However, your credit score not only affects your ability in being approved or declined but also allows for greater control and more options when it comes to the final terms of the mortgage on hand.

First, let’s address your score.

Credit scores in Canada range between a numerical value of 300 and 900. Very few Canadians have a score of 900 or even close to that and if don’t you fall into this category, take comfort.

Even if your score is somewhere within the range of 600-700 you have a good chance at lining up your application with one of the five major banks in Canada, if some of the other aspects of your application are in good order. I’ll address those other aspects in the next couple of folds into this article.

If you have a credit report that spits out a score below 600, you may have to consider talking to a bad credit mortgage broker about applying with a “B” lender or possibly securing funds in the private sector.

Having a good credit score and your associated report intact (before you go to a mortgage specialist or a bank and apply for a mortgage) is of key importance here. If your credit score is less than the minimum amount required, then improving it would be in your best interest.

There are a couple of ways to address this issue:

- Apply for a secured line of credit

- Apply for a secured loan

- Apply for one of many credit cards for bad credit

Get on top of this as soon as possible, as this might take you some time to achieve. Plan on taking between 6-12 months to adjust your credit score and reflect adequate values.

Exercise patience, and it will pay off.

Next, let’s address how having a good credit score is akin to playing a friendly game of poker, while holding 4 of a kind, with the ace of spades, and walking confidently into the bank.

Having a good score can directly lend itself to better offers with better interest rates.

If you have an excellent credit score – 760 and over – then you will have access to some of the best mortgage rates across the nation but if your credit score is below 600 don’t be surprised if the best they can offer you lies hovering somewhere between 1 or 2 percentage points above prime.

Moreover, this could jump even higher if you are unable to provide sufficient proof of income or have had recently reported credit issues such as missed payments or several applications for new credit in a relatively short period of time.

Who and What is CMHC?

Before I explain who the CMHC is, it’s important to understand how your lender assesses risk for each individual.

To a lender, there are two categories of borrowers, in terms of risk.

- High Ratio Mortgage

- Conventional Mortgage

A mortgage, where the home buyer needs to finance more than 80% of the purchase price is considered a high ratio mortgage. You can also think of this as offering less than 20% as a down payment.

As an example, Nick found a great three-bedroom bungalow with a basement through a real estate agent and would like to make an offer. The house is listed at $486,000 and Nick has saved enough funds to offer a down payment of 5% of the asking price which comes to $24,300.

There is greater risk to the lender in such a mortgage, and accordingly would require a means of fallback, in case the borrower defaults on their payments or has to foreclose on the property.

This is where CMHC arrives on the scene.

Who Are They?

CMHC which stands for Canada Mortgage and Housing Corporation is a lender-side insurance provider which offers opportunities for affordable housing that fits the budget needs of all Canadians. They realized that achieving adequate housing is a daunting task for many in this nation and that we can’t rely on federal reserves alone to mobilize nonprofit housing sectors.

Their origins date back to 1946 just before the end of World War II when they were known as Central Mortgage and Housing Corporation. In 1979, they changed their title to “Canada” Mortgage and Housing Corporation as the state-owned enterprise we know today.

In 1999, a very important milestone occurred, when a modification to the National Housing Act allowed first-time homebuyers the opportunity to put as little as 5% down payment towards their mortgage thereby removing a significant roadblock for many Canadians.

They are governed by a board that answers to parliament and owned by the sovereign of Canada. Therefore, in addition to the obvious risk involved and subsequent countermeasures employed by the bank, it’s also the law. When your down payment is less than 20%, insurance levied on top of your mortgage is mandated by government legislation.

As of 2015, they are the largest Crown corporation when measured by the sum of all assets, clocking in at just over $250 billion.

What Is It?

How Is It Calculated?

Calculating your CMHC premium is as simple as determining what down-payment bracket you reside in and multiplying the final sale price of the house by the corresponding percentage found in the chart below.

Bracket 1

Bracket 2

If you offer

Then you pay…

5% – 9.99% Down Payment

4.00%

CMHC

10% – 14.99% Down Payment

3.10%

CMHC

15% – 19.99% Down Payment

CMHC

Bracket 1

Bracket 2

If you offer

Then you pay…

5% – 9.99% Down Payment

4.00%

10% – 14.99% Down Payment

15% – 19.99% Down Payment

So, in the prior example, Nick had offered a down payment of $24,300. This amount (at exactly 5%) puts him in Bracket 1: Between 5% and 9.99%.

The total amount Nick needs to finance will be $461,700 (calculated by deducting the down payment from the purchase price).

In this bracket, Nick would pay a CMHC premium of 4% multiplied by $461,700 which has a total sum of $18,468.

Now, let’s change it up a bit. Imagine that Nick had saved up a much larger down-payment and was able to squeeze out $86,000. That’s just under 18% which puts him in Bracket 3: Between 15% and 19.99%).

The total amount Nick needs to finance will be $400,000 (calculated by deducting the down payment from the purchase price).

In this bracket, Nick would pay a CMHC premium of 2.80% of $400,000, which has a total sum of $11,200.

If you choose to pay for this premium upfront you would be saving hefty interest charges that would’ve added up over the lifespan of the loan. This could easily amount to many thousands of dollars. Or if it’s not in your current budget, you can choose to roll it into the mortgage so it gets divvied up evenly across the total amortization of the loan.

1 in 3 Canadians receive assistance from CMHC to facilitate the application and approval process for their home financing. Without the CMHC in place, there would be many Canadians who otherwise might not qualify for a mortgage at all.

What Are the Types of Mortgages Available To Me?

1. Conventional/Low Rate Mortgage

This type of mortgage is available to borrowers who can contribute 20% or more towards a down payment of the property purchase price. In this category, you do not require mortgage insurance from CMHC.

2. High Ratio Mortgages

This type of mortgage is available to borrowers who can contribute 20% or more towards a down payment of the property purchase price. In this category, you do not require mortgage insurance from CMHC.

3. Open Mortgages

With an open mortgage homebuyers are not penalized with fees if they choose to apply extra payments towards the remaining balance on the loan. Each payment over and above the monthly minimum is applied to the principle, which effectively reduces the total amount of interest owed over the life of the loan.

They’re geared towards individuals with income that varies or for those who are expecting an imminent surplus of funds, such as an inheritance or sales commissions/bonuses from work.

Regrettably, the trade-off with this type of flexibility is that interest rates are somewhat higher, hovering around prime +1%.

Generally speaking, these types of mortgages are only available for shorter terms ranging anywhere between 6 months to 12 months. However, there are some exceptions, and the lender, if they so choose, can grant longer terms that may be negotiated with a bank manager or mortgage specialist.

The good news is that any large sum of payments applied towards the mortgage balance can easily offset the extra fees incurred by the loftier interest rates.

4. Closed Mortgages

These types of mortgages are much more limited and incur penalties when borrowers break the agreements as defined in the original contract. Payment amounts cannot be refinanced or renegotiated before the maturity of the term, which could be anywhere from 3 to 5 years.

The advantage of signing into this type of mortgage agreement is the accessibility to much lower rates than when compared to its counterpart, the open mortgage. With a good credit score and optimal credit utilization, coupled with a solid confirmation of income from your employer and a copy of your T4 slips, you should have no issues securing a competitively low-interest rate with any of the 5 major Canadian banks.

These types of loans are great for those who have a steady income and don’t plan on moving or selling their home anytime within the length of the current mortgage term.

5. Fixed Rate Mortgages

Choosing a mortgage that has a fixed APR can give you peace of mind knowing that throughout the entire term, your rate will be “locked-in” and not subject to fluctuations that change with your bank’s prime rate.

Another great advantage of choosing this type of mortgage APR is that you will always know how much of your hard-earned money is being allocated towards principal and how much towards interest.

Knowing this makes it much easier to budget your monthly expenses so that you stay on track and know exactly where you sit financially.

The major blow to this option is that if the prime rate tracks lower than when you locked in, you’re stuck paying the higher interest rate for the entire remainder of the term. If the interest-rate was already low when you signed your contract, then you’ll be pleased as punch even without the extra savings.

6. Variable Rate Mortgages/Adjustable Rate Mortgages

With a Variable Rate Mortgage (VRM) or an Adjustable Rate Mortgage (ARM), the borrower can take advantage of the fluctuations in the market when the Bank of Canada sets the prime rate.

It’s pretty simple really: When the interest rate dips, you’ll pay less interest, and when it rises you’ll pay more.

However, here’s where it gets interesting…

With a VRM, your monthly payments will always be the same, but with an ARM, your monthly payments will increase or decrease depending on the direction of the fluctuations in the prime rate.

So, if you have a VRM, and the interest rate increases, your monthly installment will remain the same. However, more of your payment will go towards interest, and less will be applied to the principal. If the interest rate drops, then the reverse holds, and more of your payment will be applied towards principal and less towards interest.

Now, if you have an ARM, and the interest rate rises, so will your monthly payments. The difference here, however, is that the amount that gets applied to the principal remains the same, though you will pay more in interest. Therefore, as you indubitably predicted, when the interest rate drops, your monthly payments will also drop accordingly. The amount applied to the principal, again, remains the same, although you’ll pay less in interest.

It’s tricky to choose between one of these, but there’s certainly undeniable advantages and disadvantages to each. It’s up to you to weigh your option, and consider how not only your finances but also how your persona matches up with each.

It’s all about what you’re comfortable with from month to month.

7. Home Equity Line of Credit - HELOC

Technically, this doesn’t fall in the category of traditional mortgages, but since we’ve had many followers asking about it, I decided to throw it in for good measure. For those interested, I will be writing a second dedicated article around this topic shortly.

A home equity line of credit – as the name implies – is a line of credit made available to the homeowner, using the property itself as collateral.

It’s not unlike a credit card, as it allows the borrower access to a fixed amount of funds but with one key difference: Instead of using a fixed APR, it utilizes a variable interest rate that fluctuates parallel to prime.

Key requirements are:

- That you have at least 20% equity in your home

- Show proof of income and work status

- That you have at least 35% credit utilization (also known as DTR Debt Income Ratio)

- That you have a moderately high credit score. In the vicinity of 700 and upwards. (Below 700, you may have difficulty getting approved)

Upon approval, you may be entitled to borrow up to 65% of your home’s total value when applying with a financial institution that is federally regulated or as much as 80% when combined with your mortgage’s remaining balance. This may require a current evaluation of your property through a home appraisal.

If you already have a lot of equity built up in your home, you will have access to a greater amount of funds through your HELOC.

If not, you may still be approved, but with a low credit limit. As you pay down more of your mortgage or as the value of your home increases over time, you may request a review of your HELOC with your bank. During such a review you can request access to an increased limit, which they may grant after reviewing the requirements once more.

Whatever you borrow, you simply pay it back. Once paid, you then have access to those funds once more. As you can see, all you’re doing is borrowing money, repaying it, and borrow it again. Always up to the credit limit, just like any standard credit card.

What is Pre-Approval and Do I Need It?

Imagine you found your dream home. It had everything you could ever want in a property, and the location was ideal for your commute to work. It had a remodelled kitchen, complete with natural stone countertops, and top-of-the-line, stainless steel, french door, energy-star rated fridge. The floors were redone with 24-inch by 24-inch travertine tiles and there was a huge bay window over the double black granite composite sink, allowing lots of natural sunlight in.

Nearby, there was a large plaza that had a grocery store, a fresh fruit market, and a big-box hardware depot. Across the street, was a local chain that sold electronics and tech, and within a 5 min walk, a selection of Japanese, Italian and Mexican restaurants.

The neighbourhood had a warm feel to it, and after speaking with some of the neighbours in nearby houses, you knew you’d fit right in. There was a great school nearby, with a big park and a beautiful ravine. During nice weather, the kids could bike over to it, meet up with friends, and get some exercise and socialize.

You knew that your family had found the perfect place.

Then when you made actual arrangements with the bank to get approved for your mortgage, you got a phone call explaining all the reasons why your application was denied!

Your heart sank into your stomach. You were crushed. But the situation could’ve been avoided if only you had done your due diligence.

In this section, I am going to explain to you what the pre-approval process is and why I recommend that you get one. This is one of the more important sections in this article, so make sure you read it and then re-read it again. Absorb as much information as you can because preparedness, can make all the difference in the world.

1. What are the Advantages of Preapproval?

Your lender will lock in the quoted rate for you.

Yup. Upon pre-approval, your lender can lock in a quoted rate for you. This is valid for anywhere between 60-160 days, depending on the financial institution.

Let’s pretend you’re given a rate of 2.55% on March 20th, and it takes you until June 3 to find a great home. Now you’re ready to make a bid on the house, however, the rates have slowly crept up and now sit steady at 3.10%.

Lucky for you, you decided to get pre-approved. Your lender will honour the rate that they originally quoted you at 2.55%. If the current rate of 3.10% remain static or trend upwards, just a bit, that could add up to thousands in savings, especially if you decided to sign into a 5-year fixed term.

Know what your monthly installments will be.

It’s important that you have a good idea of what your monthly mortgage installments will be.

It’s in your lender’s best interest to assist you in determining the maximum amount that you can spend on your monthly mortgage payments. To aid in this endeavour, your lender or mortgage specialist will ask you for supporting documents that will verify your assets and income, as well as any debts such as monthly obligations or outstanding credit card balances.

After doing, they will enquire as to what type of loan you are interested in and after locking in your qualified rate, setting your amortization period and subtracting your downpayment, they can estimate your monthly payments.

Know the maximum amount you qualify for.

Most of us dream of living in brick mansions on an oversized lot, or in large country homes situated on 3 acres of land, but for the majority of us out there, this just isn’t realistic.

It’s important to know where you stand financially, as this will help you to not waste the lender’s time, nor the real estate agents. In addition, it will help you narrow down your choices, and guide you, as you are out there hitting the pavement, searching for that perfect home – within your budget.

2. What is the Process for Pre-approval?

It can differ slightly from bank to bank or from one mortgage specialist to another. However, the process usually has the borrower provide the following documents:

- List of assets that may include:

- Other homes, automobiles, or boats with no liens against them.

- Liquid assets such as savings or chequing accounts and fully mature or breakable government bonds

- List of debts such as:

- Auto loans

- Student loans

- Credit card balances

- Any financial obligations such as:

- Child support

- Alimony

- Form of identification:

- Valid Drivers License

- Passport

- Proof of employment and T4 slips

- How long you’ve been employed with your current job

- If you’re self-employed you will most likely be required to supply:

- A copy of your notice of assessment for the past two years

- Your most recent T1 general.

If you are self-employed, financial statements from bank accounts may be required to verify the values you have entered on your application.

Not every financial institution will necessarily ask for all of the items on this list. Mind you, having all of these documents ready to go is your first line of defense. It shows the bank you’re prepared and it displays your willingness to work with them to get the best possible loan, with the best interest rate available to you.

Word to the Wise - A Pre-approval is Not a Guarantee

Having a pre-approval is a great way to stay one step ahead.

Although, please keep in mind that going through the process does not guarantee your application will be approved. There are many unforeseeable’s that can get added into the pot.

You might have documents such as bank statements and T4 slips that don’t match up with your application. These documents amongst others, aren’t always required by your mortgage specialist or lender until you place a bid on a house and the official approval process is underway.

Now you’ve placed yourself in a difficult position, having supplied faulty documents and your dream home isn’t as secured as you previously thought.

You need to be honest and forthcoming with all your documents and any information that pertains to your application. Any false moves or details withheld, can be devastating to your chances of success. Know that the bank can and probably will find out what is accurate and what is not.

I also recommend that you get a copy of your credit report well in advance. This will not only give you insight as to what the bank will see but also allows you to make any adjustments on your report that may be out of date or incorrect. It will also allow you to make any financial adjustments necessary to boost your score in a matter of 6 months to a year.

The sooner you get your credit score, the better off you’ll be. Foresight is a thing of beauty.

Should I Use a Mortgage Broker or My Everyday Bank Branch?

Not long ago, if you wanted to buy a home you would visit your local neighbourhood bank branch. It just made sense. You were comfortable with them. You knew several of the employees and had a rapport with one of the bank’s manager.

All of your services were bundled with them. You had your chequing and savings accounts, as well as your auto loan, your selection of mutual funds and a safe deposit box for your valuables. Everything was neatly packaged into one organization. One institution. One size fits all.

But as cliché as it sounds, times have changed.

Some People Prefer Variety

They like options and the more options the better. It’s an ever-increasing mentality. they like to have someone competing for their business because that might result in better offers.

The thing is, banks offer very specific services, and quite often their employees are encouraged to push as many of these products as possible. But these products might not be the most beneficial to you. It depends entuirely on your finances and your “set up”.

So what can a mortgage broker offer you that the bank can’t? Let’s look into this with some detail.

What Does a Mortgage Broker Do?

A mortgage broker is a licensed specialist that acts as an intermediary on behalf of either side of a contract.

You can think of them as being similar to a matchmaker although instead of arranging relationships they arrange mortgages by pairing up a prospective borrower to an ideal lender. They have access to many financial institutions and certainly many more products that one bank can offer.

With this kind of access, they can offer a borrower a greater volume of competitive rates across a vast spectrum of lenders. Not only are they able to offer you plenty of choices but they want your mortgage application to be approved.

You see, a mortgage specialist only gets paid, if the application has been approved and a house was bought. They want you to have a win.

Using a Mortgage Broker: The Good and the Bad

The Good

The Bad

Greater selection of interest rates from a vast pool of lenders.

Won’t allow you to consolidate your mortgage and take advantage of many bundled services offered by your local bank.

For “prime clients” there is no fee or commission paid by the applicant.

If you are considered “prime” status – you have a steady job with verifiable income, a good credit score and a low credit utilization percentage – then your fees and commissions are paid directly by your lender upon approval.

Dealing with financial associates that you have no prior relationship with.

This could very well be the first time you’ve done any business with a mortgage broker, so if familiarity is important to you then you might feel a bit out of place.

They succeed where a bank might fail.

If your credit score has been hanging by a thread or you have had problems with debt in the past your bank might not be willing to overlook such historical blemishes. A mortgage broker can find you a lender that is willing to offer greater flexibility under your circumstances.

Inability to access your mortgage details and payment options through your regular bank portal.

Your mortgage broker will handle all the negotiations and most of the legwork, so that you don’t have to.

Instead of you having to search for the best rates and negotiating with multiple banks one by one, your mortgage broker will reach out to the lenders most suited to your individualized finances to find you the best terms in the least amount of time. Sometimes it’s just nice when someone else does the dirty work.

Once approved, all future contact is handled by the lender, not the broker.

In the end, it’s really up to you to decide which of these two avenues will get you the results you’re looking for. If you have a great relationship with your local bank, you know several of the staff then you might feel more comfortable going with what you already know. Having these kinds of relations can go along way in offering you a great mortgage with a low rate and terms that are on par with your expectations.

However, if you prefer not being led through every step of the way and ready to take off the training wheels, then going with a broker might be the right choice for you. You’ll get to pick the best of the bunch; have options with a subpar credit report, have access to a mixture of terms not offered by your local bank, and potentially find you not only the most competitive and lowest rate possible but one (based on your credit history) that’s indeed available to you.

What is an Open Mortgage?

Simply put, an open mortgage allows the borrower the option to repay all or part of their loan at any time, without incurring penalties. This flexibility can extend itself to any refinancing or renegotiating of the terms.

There are obvious advantages for entering into a mortgage agreement with these terms.

Perhaps you are anticipating an inheritance or plan on receiving a substantial pay raise. Or maybe you earn an income that varies from week to week, such as those in sales with commissions that have potential to fluctuate in an upward trend.

Individuals with these types of jobs or situations might be inclined to ration a large portion of their liquid assets or earnings towards their home.

However, there is a price to be had for this lack of restriction. Interest rates tend to be higher – generally hovering somewhere around prime + 1% to +2% greater – when compared to that of a closed mortgage, especially when paired with a fixed-term rate.

Despite these higher rates, those who have ongoing access to a surplus of funds might choose to allocate their earnings towards their mortgage. By doing so, they can offset the elevated interest fees charged by their lender for the remainder of the term and shave years off the loan’s maturity.

What is a Closed Mortgage?

If, after reading about open mortgages in the section above you were to infer that a closed mortgage would have the opposite implications, then you would be correct.

With a closed mortgage, there is no pre-paying or renegotiating any of the terms prior to maturity, without suffering a penalty of sorts.

For some, though, this has its appeal.

With these restrictions in place, the bank can offer a more stable interest rate – one that doesn’t jitter up and down and all around like a pre-teen on the dance floor.

We all know, that the bank makes its money off of interest. The longer the contract, the more opportunity that the institution has to collect said interest. Referencing back to the previous section, for a bank to offer an open mortgage, there would have to be some incentive for them so that they are able to make as much money as possible when the term is short. So what do they do, but hike up the interest rate offered to you and maximize their returns.

Yet with a closed mortgage, they can proposition you with a lower rate because they know that you’re unlikely to break the contract that you signed until the term reaches the end of its cycle.

Under the circumstances, by offering you a reduced percentage they can rest assured that their money will be made -though not through the ascension of the interest but by the longevity of the term.

Who Can Benefit from This Type of Mortgage?

Individuals with a steady job, that provides a steady income, with no immediate plans to relocate or sell their home and are not expecting any impending gifts or inheritances in the foreseeable future would benefit from signing into a closed mortgage.

Here’s a scenario:

An advertising executive (let’s call him Geoff) has a current mortgage, with a closed 5-year term, and choose this loan type because he was attracted to the stipulations that come with such a firm agreement. Then after 3 years, his boss offers him an opportunity that he just couldn’t refuse.

He’s noticed the hard work Geoff has been doing and the results that it’s producing. So he decides to offer him a promotion which comes with greater responsibility, a substantial pay raise, and a company car.

The only kicker is Geoff’s boss requires him to relocate from his Toronto office to their new secondary post in Vancouver. Oh, camon??

Now Geoff is forced with an executive decision – Pun very much intended.

Does he accept the offer; which ultimately means he will have to sell his house, relocate the family and muscle through some beefy penalties from the bank for breaking his contract, or does he decline the offer and continue working for the same salary, indefinitely?

Can you hear the sad trombone, making that all too well-known sound of being let down? Poor Geoff.

Just in case you forgot how that sounds, go on. Hit play. I know you wanna.

A Comparison: What is a Fixed Rate vs. a Variable Rate?

I briefly touched on this subject in the section above “What are the types of mortgages available to me?”. However, in this section, instead of recapping what we already know, I’m going to compare the two, and figure out how one of these mortgage types might allow our executive in the scenario above, to benefit from his new job offer.

So, with respect to Geoff, we know he chose a closed mortgage when his boss offered him the job promotion. But we don’t know is whether his closed mortgage was attached to a fixed rate or a variable rate.

A. Let's Pretend Geoff Chose a Fixed Term...

If Geoff decides to accept the offer and take the job, then let’s consider what type of penalties he would have to pay if he had a closed mortgage with a fixed rate.

His lender will have a choice between 2 calculations when tallying up the penalties. The amount owed would be the greater of:

or

1. Interest Accumulated Over 3 Months

So, we know that Jeff was at exactly 3 years into his 5-year term when his boss offered him the promotion. That leaves us with 2 years (or 24 months) remaining on the term.

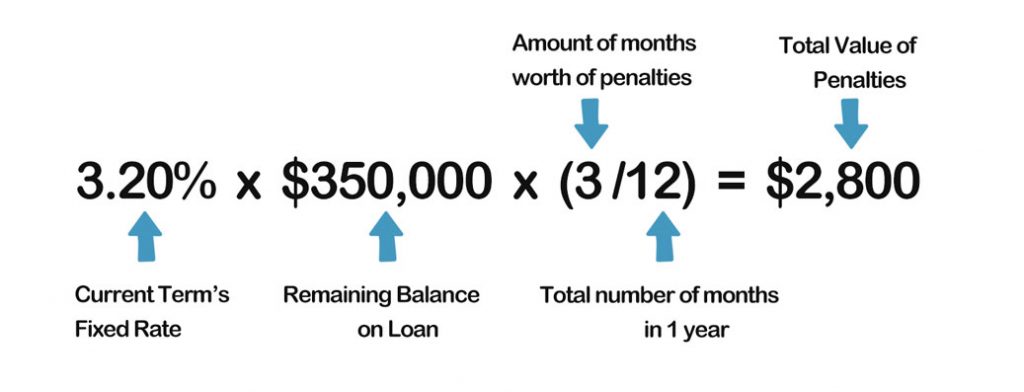

Let’s give Geoff a current balance of $350,000 remaining on his mortgage and assign him a 5-year fixed-rate A.P.R. at 3.20% as per his contract which he signed in 2017.

The calculation for that is as follows:

[Rotate To Landscape for Better View]

So far so good? Ok then, moving on.

Now I will compare the calculations in penalties using the IRD (Interest-Rate Differential) formula.

2. Using the "Interest Rate Differential" (IRD)

If you’re asking yourself, “What is an Interest Rate Differential?”, then you’re in the right place.

In a nutshell, it is the difference between your contractual fixed-rate (the rate in which you signed into when you originally secured your loan) and the current rate that most closely resembles the remaining time left in your term.

Since Geoff has 2 years remaining in his term, his lender would pick the 2-year fixed-rate currently offered by his bank, as of today. For the current rate, let’s choose 2.55% – a widely available fixed-rate utilized by many lenders today.

Therefore in Geoffs‘s case, it is the difference between his original 5-year locked-in rate of 3.20% and the current 2-year fixed rate available at his bank of 2.55%.

I then use the following calculation to determine the penalties, owed by Geoff, to his lender:

[Rotate To Landscape for Better View]

But Why is the Penalty Calculated in This Way?

Your bank offered you a discount for signing a contract of a specific length. The bank is now counting on you to make those interest payments until the end of the term. This is reflected on their balance sheet and used to project the institution’s future worth.

When you break this contract you affect the value of that institution and it’s publicly owned stock which can lead to some very angry shareholders. The differential is the institution’s way of recouping some of the earnings-through-interest that they will now no longer receive, since you are packing it in early.

Unfortunately, Not All Banks Use this Formula.

B. Let's Pretend Geoff Chose a Variable Term...

If Geoff decides to accept the offer and take the job, then let’s consider what type of penalties he would have to pay if he had a closed mortgage with a variable rate.

His lender will have only one choice.

What are the Implications of Having This Single Choice?

To fully appreciate this, first lets quickly run through 3 different lifestyle scenarios:

Lifestyle 1.

Lifestyle 2.

Lifestyle 3.

It’s the people in this last category that would benefit most from a closed variable rate mortgage.

So what you are saying, is that the middle ground between a closed fixed-rate mortgage (Lifestyle 1.) and an open mortgage (Lifestyle 2.) is the closed variable-rate mortgage?

Yes!

They Benefit, But Why?

Historically, It's Less Expensive.

If you look at the historical data, variable rates end up being less expensive in the long run, when compared to their fixed rate cousin.

Going as far back as 2008, variable rates have been consistently lower than fixed rates. From 2009-2012, the difference between variable-rate and fixed-rate was as high as 2.5%, which is huge if you think in terms of savings.

Preceding that, there was a run of almost 8 years where the variable-rate was floating, on average, around 1% below the fixed-rate percentages.

However, during a brief period around the summer of 2019, the fixed rate snuck up above the variable rate, with a difference as high as 0.30%. Then with worldwide pandemic ofCOVID-19, it firmly dropped back below the fixed-rate -only slightly though -as the markets plummeted.

The data shows consistent savings, yet still so many Canadians choose the fixed-rate because it offers more security. They don’t feel comfortable with the idea of the rate jumping around, however for those who aren’t certain of the near future, this risk is worth its weight in gold.

Only 3 Months Interest.

Getting hit with some serious IRD penalties can feel like dropping some lighter fluid on a pile of cash and sparking it up. Charges of $10,000 and higher are not uncommon with IRD, but if your penalty remains at 3 months’ interest, no matter what your circumstances are, then consider yourself lucky. You just dodged a bullet.

It’s only one option. The bank knows it and you know it. Even though you just gave up 3 months’ interest after selling your home, knowing that it could’ve been a lot worse can bring peace of mind.

Life Impending Uncertainties.

1. Failing Relationships

You and your significant other just can’t stop fighting. You know it’s inevitable – a break up, then comes separation, and possibly divorce. It’s not something anybody likes to think about but it does happen, every single day.

Your term is up for renewal in two months but your marriage’s uncertainties may last longer than that. You don’t really want to go down with the titatic, do you?

With everything going on in your relationship you’re better off renewing your mortgage with a closed variable rate. That way if things go south in your personal life, then you’ll take comfort knowing that breaking your mortgage won’t break your life.

2. Occupation

Is it possible that like Geoff, you’re anticipating a promotion that may include a generous increase in salary, possible relocation, or both. Even if the only thing that changes is your salary you may want to take some of that extra income and apply it towards your mortgage, so you can pay it down faster.

You’e thinking, “With this pay raise, it’s time to move on to greener pastures and a larger home.”

In terms of breaking your contract, selling your home will have minimal penalties incurred as it’s only 3 months’ interest. In terms of collateral damage, you’ve kept it to a minimum.

Bravo.

Let’s Conclude This Section With a Brief Summary

You’re at the bank, you’ve been approved, and you’re talking with the manager, ironing out the final details, but you’re stuck on the type of mortgage and not sure how to proceed.

Just remember to first, ask yourself these 3 questions:

- “For the next five years, is my life rocksteady?”

- “Am I content with my career?”

- Do I have a relationship or marriage that is predominantly contentful and satisfying?

- Will my salary/wages remain relatively unwavering?

If you answer with a resounding “Yes” to these questions, then a fixed-rate mortgage is the logical choice. A pursuit in this direction will give you confidence and security.

However, if you answered No, then ask yourself the following:

- “Am I planning to relocate for occupational changes?”

- “Am I leaning towards a different profession?”

- “Is my marriage or personal relationship on thin ice?”

- “Am I anticipating a promotion at work, an inheritance of sorts or did I just win the lottery?”

- “Am I a risk-taker in general, and unlike the masses, do I like to live life just on the edge?”

If you answered “Yes” to any of these questions you might want to consider choosing a variable-rate mortgage. Not only for the flexibility it provides (if you need to unwind your agreement) but also if you are comfortable knowing that your monthly payments might fluctuate.

When crunching the numbers it’s apparent that there’s promising potential to save you your hard-earned cash, if you stick with the term for whatever length of time you decide to sign on for.

You make a choice, and you pursue that course with confidence.

What is the Difference Between a Home Appraisal and a Home Inspection?

There are several misconceptions that active homebuyers (and even some real estate representatives alike) have regarding the key differences or similarities between a home inspection and a home appraisal. It would seem, especially to misguided prospectives that they are one and the same. That’s not hard to imagine.

But is there any difference really?

Most definitely. Each share several overlapping attributes. Some similarities do exist between a home inspection and a home appraisal, however, they serve different purposes.

One might say, their endgame is unique.

If I were to define their roles simplistically for you, I would say one benefits the lender more and the other benefits the buyer or the seller. That’s not entirely accurate but its close enough to get you in the ballpark. From there, I will expand on that idea in order to explore where they differ and where they are alike.

Key Differences

Home Appraisal

Home Inspection

Often a requirment set out by the lender.

Optional choice as required by seller or buyer.

Can affect lender’s decision to approve your application.

Outcome can offer advantages in negotiation for either seller or buyer.

The buyer will likely have their agent hire a home inspector to assess any safety issues present on the property. Depending on the report, this can leverage the buyer during negotiations on the final sale price. Conversely, the seller can conduct their own pre-inspection to sift out any potential red flags that might adversely affect the selling price prior to entering into a contract.

Checks for conditions of interior/exterior, and size of lot .

Determines issues to major systems and reveals risk to health and safety.

The number one priority of a home inspector is the security and well-being for the homeowner. During the inspection, if they notice any evidence of rodent/termite infestation, structural and load issues, signs of water damage in the basement or faulty electrical wiring then it will be included in the report.

Uses “comps” of nearby properties to ascertain value.

Determines issues to major systems and reveals risk to health and safety.

What is a Home Appraisal?

Home appraisals are almost always required by your lender before your mortgage is approved. They are ordered by your lender to independently assess the value of a property and confirm that the sellers asking price is not in excess of the appraiser’s recent evaluation. It is conducted by an unbiased third-party professional.

Prior to the appraisal, your lender will check out your credit history, income and all supplied documents. Once they approve your application, you’ll get the green-light and move on to the property assessment.

This is where an appraiser undergoes a physical assessment of the property itself. The listing agent or the seller will make an appointment for a time that’s convenient for both the current owner and the professional conducting the evaluation.

Once the appraiser arrives on the property the inspection usually takes no more than 30 minutes. If you are having a rather large property appraised or there are complex evaluations involved it may take longer, possibly upwards of 2 hours, so be prepared for that.

Specifically, what do they inspect?

The appraiser runs through a checklist that includes inquiries regarding the maintenance and condition of the property, geographic location, and any recent “comps”.

They will ask questions and take notes on:

- The age of the property

- Interior renovations to the bathroom, kithcen, (basement if applicable) and any other changes or repairs.

- Electrical upgrades

- Plumbing upgardes

- Total number of rooms

- Age of applicances

- Condition, age of the roof and any known issues/repairs.

- Nearby schools and amenities

- Comparable homes in the area and the how much they recently sold for.

An appraiser’s opinion heavily relies on the comparable market value of nearby homes, and any recent sales of these properties within the neighbourhood, as this may influence their final valuation.

What is a Home Inspection?

A home inspection is a voluntary procedure for both the buyer and the seller. It allows for a trained professional to perform a visual evaluation later summed up in a written report, that notifies either side of the transaction, about any outstanding safety issues or health hazards pertaining to the property of interest.

The main thing to take away from this is that it is almost entirely to do with safety that is not so concerned with cosmetics nor total market value

Just as it was with a home appraiser, an appointment is made and a professional arrives on the premises on the date and time mutually agreed upon.

An inspector will start with visual observations, going from room to room, ideally with the current homeowner or a senior/well-advised member of the household. They will take notes in multiple categories while generating inquiries for the homeowner.

They might also ask the seller if they have kept any of the receipts for services rendered to show as proof of repairs performed. This would reflect well on the seller’s part, indicating not only the timely maintenance of the property but also displays a level of transparency, which in turn can build trust. This could give the prospective homebuyer a better sense of the overall condition of the house.

What kinds of things are they looking for?

Be prepared for any competent inspector to take note of the general condition and age of :

- HVAC, (all Heating Venting and AC)

- Windows

- Interior and exterior doors, including walkout basements and sliding glass enclosures.

- Electrical circuits and the mains and any subpanels

- Structural and foundation

- Presence of a sump pump and/or backwater valve.

- Basements have unblocked access to at least one floor drain.

- Banisters and railings

- Visible plumbing from the basement and all fixtures within the home, including functional drains in sinks, showers, bathtubs, and toilets.

- Visible mold in the basement or near and around areas of moisture such as the kitchen and bathrooms

- Cracks in any walls that may indicate poor structural integrity

- Condition of the roof – missing shingles, unwanted wildlife-accessible openings, proper pest control housings on every plumbing vent, chimney vent, and dryer vent

- Water runoff systems i.e. eavestrough’s, downspouts.

- Installation of French drain or weeping tiles

- Age of septic tank if it’s if applicable

- Maintenance and condition of well water and drinking water filtration systems

- If the ground slopes away slope around the perimeter of the house and the nature of the materials surrounding the house i.e. concrete, dirt, grass or gravel

- Exterior wall insulation present

- Signs of rodent or termites/insect infestation

- Wood-burning appliance inspection (can only be carried out by a certified WETT inspector).

One of the differences, when comparing it to a home appraisal, is that lenders do not require nor enforce a buyer or a seller, to obtain a home inspection, as part of the approval process.

That being said, considering the relatively low cost, it is worth its weight in gold. Saving a few hundred dollars after you’ve already agreed to a down payment upwards of $20,000 or more doesn’t make a whole lot of sense.

If you compare the price to having the foresight of a house that will end up costing much more in ongoing repairs, you’re better off playing it smart. Hire a professional who can accurately examine the entire property head to toe.

If you’re still not convinced, try to imagine ongoing costly repairs stemming from structural flaws or a leaking moldy basement. Better yet, think of all the fun you’ll have while watching a crew of workmen, strip down and peel back every layer of your roof – from the rotting plywood panels right on up to the last lone shingle – because you decided to pocket the cash and forgo the inspection.

Just look at what happened to Tom Hanks and Shelley Long in “The Money Pit”. Tears of laughter in movieland. Tears of pain and suffering in realityland.

Home inspection from a seller's perspective.

A buyer will always begin the inspection process after they engage in a contract with the seller, frequently after a deposit has been placed into escrow.

The seller, however, will commonly have what’s called a “pre-inspection” anywhere from a few weeks to a month or more, prior to listing the property on the market.

Getting an inspection this far in advance allows the seller to be realistic when pricing the home. If multiple safety flaws and structural issues are found, at least the seller knows what to expect from the buyer. This also allows them to avoid any nasty surprises.

The seller can choose to make the necessary repairs or allow the property to be listed, as is, at a lower rate to match the market value based on these findings.

As a seller, it is highly recommended that you have the home inspected prior to listing it with your realtor, so that you are aware of any significant flaws that may disrupt the flow of those interested in purchasing your property.

Final Notes

A few final reminders of some very important items that should be included in your agenda. Don’t forget about these!

If you think it’ll help, write a sticky note and slap it on your forehead. That way your spouse always has an excuse to slap you on the noggin and remind you of the things you almost lost to the aether.

- Packing and moving day.

- Renting a truck and doing it yourself vs hiring a moving company.

- Transferring bills and utilities to new address.

- Transferring mobile communication services.

- Forwarding mail.

- Closing day and getting the keys.

Congratulations! You did it.

Related Topics