FICO: The Mother of All Credit Scores

I

July 7, 2020

I

July 7, 2020

Fair Issac Corporation: The Early Years

Way back when there was no credit monitoring system at all and a loans officer developed a strong sense of their potential customers through face-to-face interactions, a verbal inquiry, and a handshake were all you needed to start your credit file with the bank.

FICO and its origins date back to 1956 when two friends from Stanford Research Institute hatched an idea that would flip the business world on its back, with a radical concept that a machine could process calculations that could determine one’s creditworthiness.

This era – with its baby boomers, its cold war rivals and their “Race to Space”, and the controversial emergence of rock ‘n’ roll – was naïve to the power and promise of modern-day computers. To think that eventually, one of these machines could beat a human in a game of chess (even against the very best in the world) let alone store and process almost 50 zettabytes of information, was unfathomable.

But, as fate would have it, two young men – one born and raised in Buffalo, New York and the other with its roots deeply planted in the San Francisco Bay Area – were destined to meet to introduce an idea that was initially scoffed at and preposterously unheard of.

These conceptualists were determined to prove to the world, that urban and rural bank associates alike (who knew their clientele intimately) were lacking the analytical capabilities to process large amounts of data that could decisively determine one’s ability to timely pay back their loans.

“Engineer Bill Fair and mathematician Earl Issac founded FICO – with an initial investment of $400 each – on the principle that data, used intelligently, can improve business decisions.”

“Engineer Bill Fair and mathematician Earl Issac founded FICO – with an initial investment of $400 each – on the principle that data, used intelligently, can improve business decisions.”

One with a degree in engineering and the other a graduate with a Master of Science in Mathematics, Bill Fair and Earl Issac respectively, set up their operation in a small studio apartment in San Rafael, California. The year was 1956. Computers were, generally speaking, nowhere to be found and widely inaccessible to anybody, in any nation globally.

Bill and Earl Give Birth to an Idea - Proprietary Product Support

San Rafael, California – Circa 1958

Their start-up funds consisted of pooling together $400 each, allowing them to secure the necessary tools to start their venture. With a borrowed computer from a California-based oil refinery, Bill and Earl were en route. Their initial goal was to use this bulky equipment to generate statistics and analyze patterns using simple points of data such as bank balances, individual outstanding debts and historical payments.

Their endgame was to pitch these results to prospective banks and financial institutions. Their product could provide an ongoing service that could accurately assess the level of any individual’s risk using a numbered system.

The Boys of FICO Catch Their First Fish

Their initial sales pitch was met with much disdain. The boys solicited the 50 most influential banks in the United States only to be turned down by all but one. A lender by the name of “American Investments” decided they were intrigued by Bill and Earl’s proposal and two years later in 1958 FICO credit scoring system was underway.

Early Mainframe Design – Circa 1962

The data returned by these “new devices” was astonishing, to say the least. The number of patrons who qualified as results of the output provided by Bill and Earl‘s algorithms was significantly higher.

With all the potential that this analytical framework could provide to American lenders, you would think that these boys would be swimming with contracts and negotiating terms with banks coast to coast. But this wasn’t the case.

Despite their unprecedented visions, these boys floated along undetected by most of the financial world for a couple of decades.

Long Awaited Breakthrough

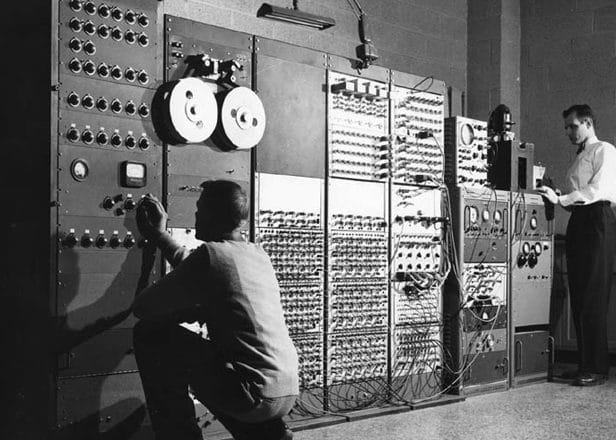

Showcasing first Wells Fargo ATM – Circa 1972

In 1972, almost 15 years after the initial FICO scoring system was birthed, the dynamic duo had a breakthrough. FICO developed the first automated system to process new credit and loan applicants using credit scores. They supplied this new modus operandi to one of the top 5 U.S. banks, Wells Fargo.

By the late 1970s, the boys of FICO begin working on a project that would allow them access to consumer reports, supplied by banks nationwide in hopes of generating a standardized reporting blueprint. Little did they know that this project of theirs would be 10 years in the making, but it was well worth the effort.

Such an endeavour would set them up for years and years of continued success, and eventually, it would be the mould from which all credit reports were cast. This early model paved the way for further advancements and by the early 1980s, the statistical software envisioned by FICO was a key player in consumer credit assessment.

FICO Goes Public on the U.S. Exchange

Inside the New York Stock Exchange

In 1986 Bill and Earl made their appearance in the Big Apple to ring the bell and signify their status as a publicly traded company on the NYSE.

Eventually, they would relocate their U.S. base of operations twice. First to Minneapolis, Minnesota and finally to their current home in San Jose, California.

Success Extends Their Global Reach

Throughout the next three decades, they would go on to expand their product worldwide, setting up European headquarters in Birmingham UK after establishing an overseas base in Monaco and continuing their expansion into Beijing.

Since then, FICO has been a global leader in the ongoing advancement of algorithmic software to provide accurate credit analysis for all lenders coast to coast.

How Do I Obtain a Copy of My FICO Credit Report in Canada?

Is This the Exact Same Credit Report That My Bank Can See?

Related Topics